Fed Beige Book Shows Modest Growth, Cooling Labor Market

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment.

The latest Beige Book is in line with other sentiment indicators showing modest growth but increased post-election expectations. The picture remains the same for employment, with a slowing-but-not-collapsing labor market. Consumer spending also exhibited some minor cracks, with higher price sensitivity and reduced spending on big items.

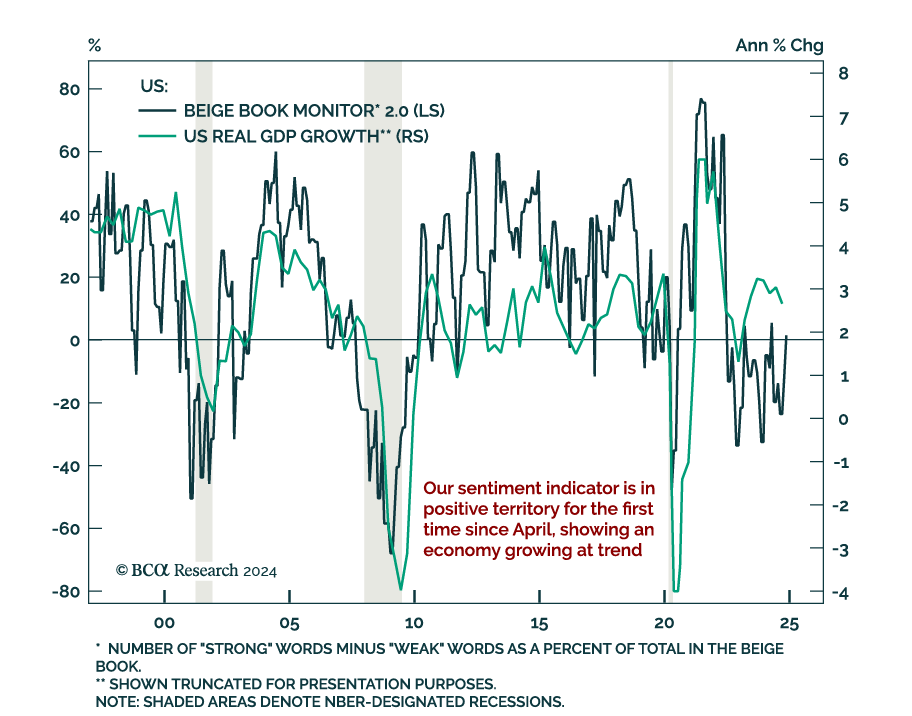

Our Beige Book Monitor confirms this narrative. Our sentiment indicator is in positive territory for the first time since April. The growth re-acceleration is, however, already reflected in asset prices. Despite Chairman Powell signaling more patience for rate cuts given recent data strength, our base case continues to call for a recession next year. We expect further slowdown in the labor market to stifle US consumer spending, and global growth to suffer due to trade tensions. Accordingly, our US Bond strategists recommend maintaining above-benchmark portfolio duration and steepener positions on a 6-to-12 months basis. They are also tactically long the December 2025 federal funds futures contract.