Heed The Signal From Commodities

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that industrial applications account for roughly half of silver demand.

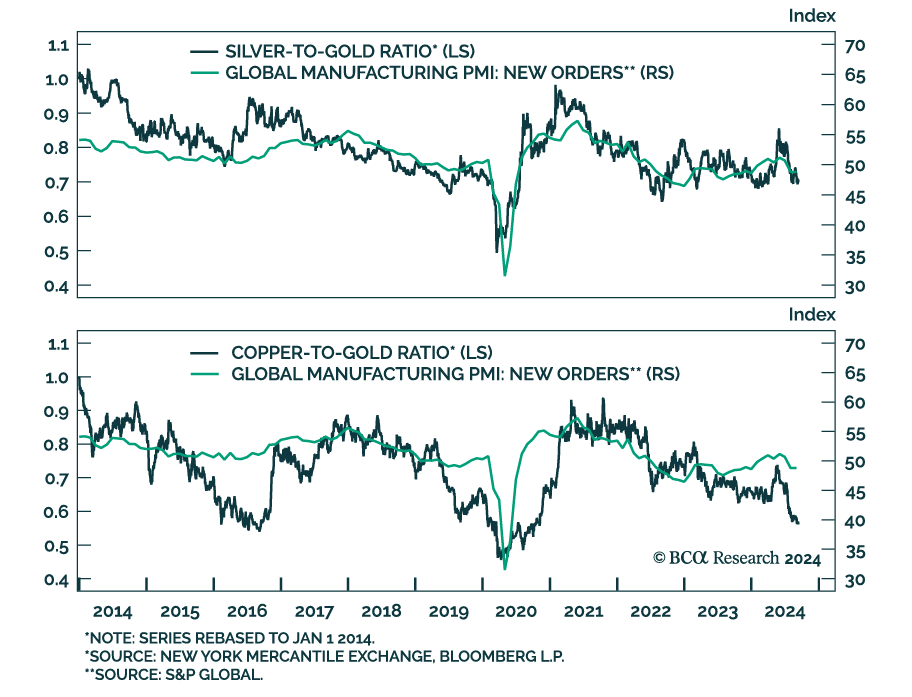

The silver-to-gold and copper-to-gold ratios are therefore coincident indicators of the global manufacturing cycle. They have fallen 17% and 23%, respectively, from their May peaks.

Our Commodity and Energy strategists have demonstrated that industrial metals lead the rest of the commodity complex around business cycle inflection points, making the signal from copper particularly noteworthy.

Conversely, energy prices tend to lag the broader commodity complex around business cycle turning points. Nevertheless, the recent oil sell-off has been demand-driven and has been demand driven and impervious to bullish supply-side developments. Oil prices are thus also symptomatic of deteriorating economic conditions.

The US has been a large driver of global demand this cycle but we do not expect it to continue propping it up beyond early 2025. We expect continued deterioration in US labor demand (see The Numbers) to tip the US economy into a recession on a cyclical investment horizon. Meanwhile, the nature and scope of China’s stimulus make it unlikely to meaningfully revive global demand.

We ultimately expect a recession in the US to morph into a global slowdown on a cyclical investment horizon. Investors should underweight pro-cyclical EM equities, Eurozone equities and favor the counter-cyclical USD and safe-haven JPY.